Egypt central bank, investors reach agreement to settle pre-float credit lines

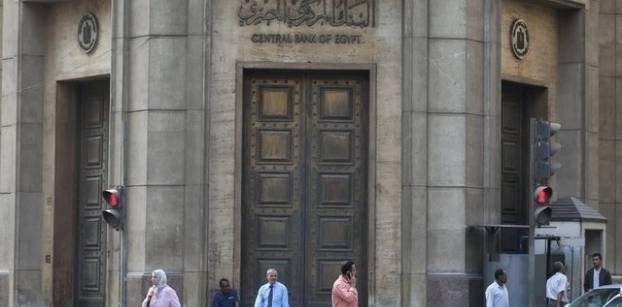

Egypt's central bank (Mohamed Abdel Ghany/Reuters)

CAIRO, Feb 21 (Reuters) - Egypt's central bank has agreed with Egyptian investors to settle credit lines opened before it floated the pound in November, alleviating debts that threatened the closure of some firms, bankers said on Tuesday.

It agreed with the Egyptian Federation of Investors Associations (EFIA) to settle dollar debts resulting from the exchange rate differences after the pound's float. Many debts doubled as the pound lost half its value.

Under the agreement, about 570 companies will repay the debts in Egyptian pounds over two years with a 12 percent interest rate, the bankers said.

The agreement only applies to firms with debts that do not exceed $5 million and the exchange rate will be the rate on the settlement date.

"The central bank governor had agreed in the meeting that the central bank would cover currency differences of $500 million to banks on behalf of 570 firms," said the chairman of one of Egypt's public banks who attended the meeting.

"In return, the firms will repay the debt in the local currency with a 12 percent interest rate over two years," said the banker, who asked not to be identified. "The central bank has given firms two weeks to come forward with their requests."

Thousands of importers were caught out by the central bank's floatation of the pound on Nov. 3, which has since halved the unit's official value and caused their debts to swell.

The Egyptian pound rebounded this week to around 15.8 per dollar from lows close to 20 pounds per dollar in December as demand for dollars at banks eased over the past couple of weeks.

Still, some importers are not happy with the deal, saying the rate of the dollar that they will have to pay their credit lines with is still too high for them to afford.

"We shouldn't have to carry this burden. We bought and sold our goods at the pre-float rate for the dollar. We cannot pay back the debts at the current rate, not even over two years or more," one importer, who declined to be named, told Reuters.

Investors who are not able to pay back their debts within two years will be given a longer period, but at the interest rate offered at banks after the two years, another banker who attended the meeting told Reuters.

"The central bank advised the banks that attended the meeting to study the debts of companies that exceed $5 million on a case-by-case basis," he said.

The central bank has not issued any official statement and bankers say they have not received any written orders about the agreement yet. (Reporting by Ehab Farouk and Asma Alsharif; Editing by Tom Heneghan)

facebook comments